Table of Content

Now, some banks don't like it because typically they like a stick-built structure. That's more of what they're used to as far as the banks go. But nevertheless, when you've got that kind of loan, then typically your interest rate might be around the regular residential rates of all the other stick-built structures out there. So let's just say right now their rates going to be roughly five to 6% possibly.

But these loans also require a lien on your home which means you could lose the home if you fail to make payments. Moderate-income buyers (incomes of 115% or less of their area’s median) can use USDA Guaranteed Loans which come from private lenders. If your manufactured house meets the guidelines above, you may be able to finance it with a traditional home mortgage.

Chattel loans

USDA Rural Housing loans require no down payment. This loan program is friendly to manufactured home buyers as long as the home is brand new. Property that can be moved and used elsewhere — a car, a boat, or a true mobile home, for example — is considered personal property. So on that note, I would say that really across the entire spectrum from the parks to the homes, our interest rates are very much in sync with Sam Zell's principles of risk and reward.

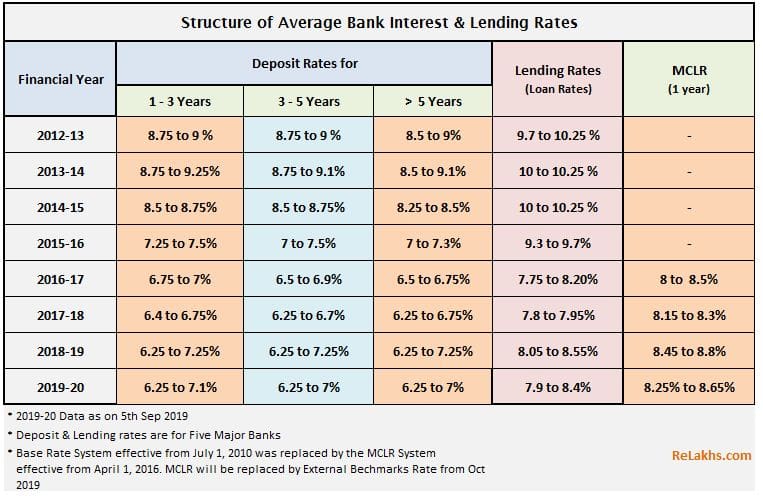

Rate & APR, find ARM, fixed rate mortgages for 30 year loans & more along with Bankrate’s weekly analysis & tips. Financing Manufactured Homes – The New York Times – The Consumer Financial Protection Bureau estimated the typical interest rate for a manufactured home loan in 2012 at 6.79 percent.. The average 30-year fixed rate on a conventional mortgage.

Current Mobile Home Interest Rates

Manufacturers of mobile homes technically stopped producing them in 1976. But the term remains in common use around the US. You don’t need to buy the land you intend to place your mobile home on.

While this does mean less money spent on interest, the monthly payments on a 15-year loan are consistently higher in all states. The VA loan program includes financing for manufactured homes. Buyers must put 5 percent down, and the loan terms are shorter — between 20 and 25 years, depending on the property.

Who can get a manufactured home loan?

Most likely, that’s a Fannie Mae, Freddie Mac, or government-backed mortgage program. Most manufactured homes, especially double-wide or modular homes, easily meet this requirement. That June day in 1976 is important because it’s when the Department of Housing and Urban Development started regulating the safety of manufactured homes. Rates can vary quite a bit from lender to lender, and from area to area.

Interest rate and program terms are subject to change without notice. ARMs are a great option if you expect to sell your house or refinance before the initial fixed-rate period ends. A homeowner could buy the manufactured home separately from the lot or along with the lot. Or, if using a chattel or personal loan, the homeowner could place the home on rented land.

So the way it normally works is with the capital partner, you've got return of capital, then you have preferred return, and then you have a split of equity of anything after preferred return. And total interest costs, and the longer term builds equity more slowly than would a 20- or 15-year term. For a variety of mortgage products, and learn how we can help you reach your home financing goals. Get to know various Interest Rates of Savings accounts, Loans for Personal and Business.

While it's useful to know what rates you can expect on. In a week or less, you can have the funds to help purchase a home. The U.S. Department of Veterans Affairs insures loans for veterans and active duty military members.

While compensation arrangements may affect the order, position or placement of product information, it doesn't influence our assessment of those products. Please don't interpret the order in which products appear on our Site as any endorsement or recommendation from us. Finder.com compares a wide range of products, providers and services but we don't provide information on all available products, providers or services. Please appreciate that there may be other options available to you than the products, providers or services covered by our service. Like renting, you’ll agree to a set lease period with a contract that includes what is — and isn’t — included in your lease. Some owners offer amenities like garbage pickup, gardening services and maintenance.

To get the best manufactured home loan rates, look for a home that qualifies for a traditional mortgage and shop around with at least three different lenders. With Fannie Mae and Freddie Mac conventional loans, you can put as little as 3 percent down. There are extra risk-based fees for manufactured home loans, so rates are slightly higher. If the taxes go to the DMV, the home is considered personal property. In addition, a home on leased land won’t be considered real property. If you’re buying a new home from a dealer, you’ll need to place the home on land you own or land you’re buying.

However, some loans are issues for shorter terms, such as 10, 15, 20 or 25 years. It is worth noting that it can be difficult to qualify for a loan to construct a shipping container home. Lenders tend to be conservative with this type of construction. We currently don’t have a list of lenders who might be able to finance your shipping container home.

However, You may still try to reach out to one of the lenders listed on this page. Compare your options first and check with the lender your eligibility. Manufactured homes, commonly called mobile homes, are single units that remain on a steel chassis even when the wheels are removed and the exterior is finished. Modular homes are often built in pieces and sent to the build site. Once in place, they resemble traditional homes and generally cannot be moved.

Average Mobile Home Interest Rate

Manufactured or prefabricated homes are considered either personal or real property — the distinction determines what type of loan you’re eligible for. 30 Year Mortgate Rates The average rate on 30-year fixed-rate mortgages is unchanged this week, at 3.75%, says mortgage giant Freddie Mac. The loans in the survey come with an average 0.5 point.

No comments:

Post a Comment